Child poverty is likely to be one of the big issues in the 2014 general election.

On the political left are a line-up of parties that are trying to make the case that child poverty in New Zealand is going from bad to worse – the so-called gap between rich and poor is growing wider, the working poor are losing out to others, and more than a third of all children are living in poverty.

And on the right are parties claiming that the economy is improving, that New Zealand’s social mobility means that notions of an entrenched rich-poor gap are meaningless, and that claims that poverty has afflicted hundreds of thousands of children just don’t stack up.

This doesn’t mean that deprivation does not exist in New Zealand – of course it does. In any society there will always be families that are not able to cope. That’s where the state should step in with a strong safety net to provide support while they find their feet and become self-reliant. Some, of course, will never be able to provide for themselves, and will need the on-going security of welfare support – but they are in a small minority.

Every election year, opposition parties try to discredit the government by making the case that they are failing to care for those in need and are mismanaging the economy. However, since it was the Labour Party that was responsible for pushing the country into a recession when it was last in government, through high taxes and big spending, they have realised that they cannot win on the economic front – especially when their only hope of forming a government is in coalition with the Greens. With a green noose around their neck and a poor track record, the economy is not a viable battlefield for Labour – especially as National’s prudent economic management during the global economic crisis has resulted in steady growth and an expected budget surplus.

Unable to fight on the economic front, David Cunliffe is turning back the clock to old Labour and the politics of envy. By railing against the rich-poor divide, he is setting the scene for a rise in the top rate of tax. This is what the trade unions want and what David Cunliffe will deliver to them, should he become prime minister – he is after all the trade union’s man. He was strongly supported by the union movement to become Labour’s leader and, having just appointed a leading union organiser to be his chief of staff, he is likely to adopt the trade union policy of raising the top rate of income tax to 45 cents in the dollar on incomes over $150,000.

The problem for Labour is that excessive taxes will halt economic growth and result in much less tax revenue for the government. By penalising aspiration, enterprise and success with high tax rates, Labour will discourage hard work, driving many with money and assets offshore to countries with more favourable tax regimes. Poorer New Zealanders will be left to shoulder the country’s tax burden.

The point is that policies designed to make the rich poorer also make the poor poorer. Steep progressive tax and income redistribution policies are based on the notion that there is only a finite amount of wealth to go around. Proponents believe that governments know best how to carve up that wealth to give a greater proportion to lower income earners and make society a “fairer” place.

But in reality, the ability of entrepreneurs to create wealth in a free society – with the right incentives of a low tax and regulatory burden – is unlimited. All the government has to do is remove the roadblocks and keep out of the way! Creating wealth leads to more jobs, higher living standards and better opportunities for struggling families to get ahead. It is a virtuous circle.

Renowned economist Milton Friedman explained it in this way, “A free society releases the energies and abilities of people to pursue their own objectives. Freedom means diversity but also mobility. It preserves the opportunity for today’s disadvantaged to become tomorrow’s privileged and, in the process, enables everyone, from top to bottom, to enjoy a fuller and richer life”.[1]

New Zealand has always enjoyed high levels of income mobility. A 2012 Treasury report confirmed that over time family income can change substantially, with the greatest mobility amongst the lower income groups.[2] They found that 74 percent of the families in the bottom 10 percent of family incomes were no longer there seven years later. Similarly, only 46 percent of those in the top decile were still there seven years later.

The study also found that the link between low incomes and deprivation was not as strong as might be expected, with only a third of the people who had been on a low income for the whole of the seven year period experiencing any form of deprivation. In other words, given an opportunity to improve their circumstances, most families will do so. This means that implementing policies to encourage wealth creation and grow the economic pie is the very best way for governments to lift families out of poverty. Conversely, the worst thing that governments can do is to introduce policies that will stifle growth by crushing freedom, wealth creation and entrepreneurial aspiration.

This is extremely important when considering the line of attack that Labour and the Greens are currently using against National. However, claiming that it doesn’t care about families and children living in poverty is disingenuous on a number of fronts.

First of all it ignores the fact that more is now being spent on vulnerable families and children than ever before, including almost $5 billion a year on benefits, $2.1 billion on Working for Families, $2 billion on subsidising housing through Income Related Rents and the Accommodation Supplement, $1.4 billion on free early childhood education, $250 million on child health initiatives, and $350 million on insulating homes.[3]

But secondly, and most importantly, if Labour and the Greens – and all of the other advocacy groups that are rallying behind the child poverty cause – really cared about those children who are living in poverty, their primary target would be families on welfare, rather than working families. If they were genuine, they would be calling for stronger welfare reform measures to help sole parent beneficiaries find employment, since all of the evidence points to children living in single parent families that are reliant on welfare in the long term, as being at the greatest risk of deprivation and poor outcomes.

This was confirmed by the Ministerial Committee on Poverty last year. It found that the group of New Zealand households with children that are experiencing the lowest incomes and the highest risk factors are those in the benefit system. They said that because of the structure of our tax-transfer system, only a quarter of children in low income households have an adult in full-time employment – the vast majority of children experiencing poverty live in families reliant on benefits.

Before National’s latest welfare reforms had come into effect, one in five New Zealand children were likely to spend more than half of their first 14 years in benefit-led households facing the highest risk of material hardship and poor outcomes. Of the 205,000 New Zealand children in benefit-led households in 2007, four out of five were supported by the single parent benefit.

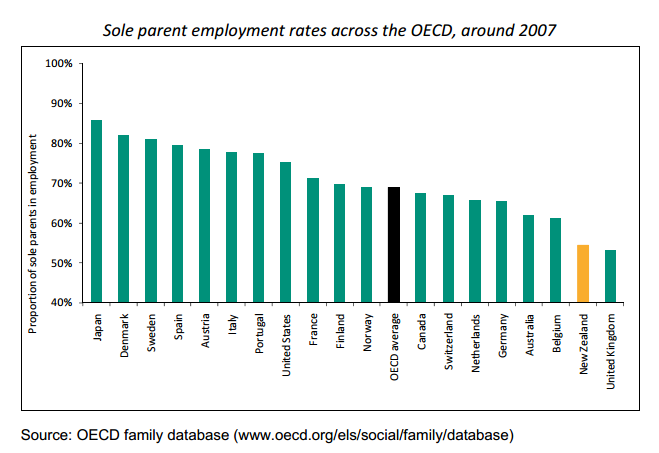

Taking an international perspective, New Zealand – along with the US, UK, Canada, Sweden, Denmark and Australia – is one of a number of countries with very high rates of sole parenthood. What is extremely important to note however, is that in those countries with high rates of sole parent employment – such as Denmark, Sweden, France, Norway and Finland – child poverty rates are low. Many of these countries require sole parents to look for work when their youngest child is quite young – 13 months old in Nordic countries.

Because New Zealand has one of the OECD’s lowest rates of sole parent employment, we have one of the highest rates of child poverty. The two go hand in hand. In other words, the international evidence shows conclusively that requiring sole parents on a benefit to take up work is the single most effective way of reducing child poverty.

So, in their campaign against child poverty, are Labour and the Greens focussing on the children of sole parents on welfare as being in the worst position? Are they sharing their policy prescriptions for helping them to move off benefits into work? No, they are silent about the plight of these children, because encouraging beneficiaries into work is not part of their political agenda. If they were really genuine, first and foremost, they would focus on strengthening the work requirement for sole parent families, and secondly, they would crank up the economy to create more jobs through lower taxes, less regulation and reduced government spending.

Instead, parties of the left and child poverty advocates promote the opposite – more generous welfare, higher taxes, stronger regulation, and more government spending. This can only mean they are not genuine and instead are trying to pull the wool over the voters’ eyes using empty rhetoric to win support from the uninformed.

To disguise the fact that they are ignoring the plight of those beneficiary families with children that are experiencing the deepest deprivation, Labour and the Greens have been highlighting the difficulties faced by low-income working families. While hardship is a serious issue, the best way to help working families is to grow the economy, creating rising incomes and a buoyant job market. More government hand-outs are not the answer, since in the long term they create a benefit trap that incentivises families to stay put rather than striving to get ahead and facing hefty abatement rates, which mean that for every additional dollar they earn, a substantial sum is clawed back.

This week’s NZCPR Guest Commentator, welfare researcher Lindsay Mitchell, has provided an analysis of the state of play regarding the politics of child poverty. She explains:

“The majority of poor children rely on benefit income. Most begin there at birth or shortly after, and around half remain there for 7 or more years. It’s important to note it’s not the unemployment benefit supporting most of these children. In 2013 only 6 percent had a parent on the unemployment benefit. 77 percent had a parent on the DPB.

“When Treasury looked at those at-risk it found more than half of the officially poor children were not experiencing hardship. The largest group experiencing hardship also had persistently low incomes. This suggests they are children in beneficiary homes. Broadly speaking, children in poor working homes tend to experience temporary poverty; children in beneficiary home experience chronic poverty. It’s the second experience that harms. Therefore, the alleviation of child poverty should be sharply focussed on welfare dependence.”

So there we have it. If political parties and advocacy groups are genuine about wanting to reduce child poverty, they need to promote work for sole parent beneficiary families as a priority – along with the conditions for economic growth and job creation, namely lower taxes and less regulation. Anything other than that shows how insincere they really are.

THIS WEEK’S POLL ASKS:

Do you believe raising New Zealand’s top tax rate to 45 percent on incomes over $150,000 would help to alleviate child poverty?

Click HERE to vote

Click HERE to see all NZCPR poll results

FOOTNOTES:

1. Milton and Rose Friedman, Free to Choose

2. Treasury, A descriptive analysis of income and deprivation in New Zealand

3. Deputy Prime Minister, Six Monthly Report of the Ministerial Committee on Poverty