Capital Gains Tax

The Government has rejected the Tax Working Group’s recommendations for the introduction of a capital gains tax. This would have taxed, at the owner’s marginal rate which typically is 33%, gains on most forms of asset holding, including the sale of a business. The principal exemption would have been gains on owner-occupied residential property. One of the effects of such a capital gains tax would have been on economic growth. Economic growth is important as it is the source of increases over time in average incomes.

Economic growth

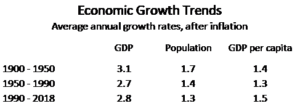

Gross Domestic Product (GDP) measures total final production which is the same as total income. New Zealand’s GDP growth trends have been:

The key indicator is the growth of average incomes, or GDP per capita. This growth rate is only around 1.4% a year. Over the years, though, even this modest growth generates large increases in our living standards and underpins other benefits, such as improved health, extended education and more leisure time.

Economic growth is, in the jargon, not a zero-sum game. In other words, for some people to get higher incomes does not mean that other people must receive lower incomes. In the longer-term, everyone gains from economic growth. Economic growth is a rising tide that lifts all boats (incomes).

But the time scales are long – it takes many years for growth at a 1.4% rate to generate large increases in average incomes. For example, it would take 30 years for average incomes to increase by 50%. In three years, one Parliamentary term, growth at the average rate would increase incomes by a hardly noticeable 4%.

The role of capital in growth

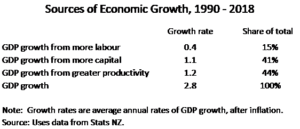

GDP, on the production side, increases a result of more inputs of capital, more inputs of labour and increasing efficiency or productivity. These sources can be measured by a technique called Growth Accounting.

The key point of these growth accounts is that 85% of economic growth and more than 100% of growth in average incomes comes from more capital and greater productivity.

Capital is vital to understanding where we are today in terms of incomes and living standards, just as capital is vital to ongoing growth. More capital accounts for around half of growth in average incomes; in addition, better capital, with technological advances and other productivity improvements embodied in new capital, accounts for a further part of income growth. In short, the major part of economic growth is associated with more and better capital.

Effects on growth of a capital gains tax

Investment in new assets is the source of growth in capital. Prospective income provides the incentive for this investment. Business owners or companies invest to add to their future earnings capability. These investments may be in rental property, in business property, in machinery, in transportation equipment, in IT equipment, in software and intellectual property, or other types of productive assets. The driving force in all cases is to continue and increase the earnings potential of businesses. Increasing the rate of tax on capital, whether on capital income or capital gains, has the effect of reducing prospective returns; this reduces the incentive to invest.

Investment in new assets must be paid for. One source of this funding is the sale of assets or businesses. Increasing tax rates, including introducing a capital gains tax, reduces these funds available for investment.

The efficiency component of future growth would have also been affected by a capital gains tax. Working to improve efficiency, with the payoff being increased future earnings, would have been partly discouraged by a tax on increases in business value.

In short, the proposed capital gains tax would have reduced both the incentive and the ability to invest in new capital as well as to make changes that increase productive efficiency.

Conclusion on capital gains tax

Economic growth is a long-term process which increases all incomes. The entire growth in average incomes comes from more capital and improvements in productivity.

Increases in capital taxation reduce both the incentive and ability to invest in new capital. Similarly, the incentive to pursue efficiency improvements in business would also be reduced. These would slow the rate of economic growth, the rate of growth in average incomes.

Economic growth is a long-term process. Changes, such as those associated with a capital gains tax, would be small in the first few years but steadily increase over time. However, these effects would be invisible as they would slow the rate of growth from what it otherwise would have been, not reduce incomes from one year to the next.

The Tax Working Group’s proposed capital gains tax had not taken account of the effects on economic growth. The effects within one Parliamentary term would hardly be noticed and even the longer-term effects on people’s incomes, which could be substantial, would be invisible. The Tax Working Group might have been able to disregard these effects but, from an economic point of view, it was unwise to ignore them.

Conclusion on policy

The foundations for economic growth remain in place now that the Government has ruled out a capital gains tax. All income taxes impact capital income. Increases in income taxes in general, or taxes on capital in particular, have a disincentive impact on work and investment. These effects slow the growth in incomes and living standards. To continue New Zealand’s long-term income growth, the Government would be well advised to live within its means rather than searching for new taxes to fund additional spending.

Foresight in economic policy-making is a rare thing. Unfortunately, economic growth is a gradual and long-term process whereas political considerations often are bounded by the next election. It is all too easy for governments to let short term thinking over-ride consideration of long-term effects and economic growth is very much a long-term effect. Responsible governments, and there have been some, do take account of the longer-term effects of their policies. It is to be hoped that present and future governments share a broader and far-sighted perspective.